Snapshot of the SF Economy As of May 2025

June 11, 2025

May data shows flat employment, stronger downtown activity, and mixed housing trends.

A new report from the SF Controller shows that downtown is slowly but steadily recovering as employment holds flat, transit ridership hits new highs, and rents climb—though tech layoffs and housing supply constraints temper optimism.

The Facts

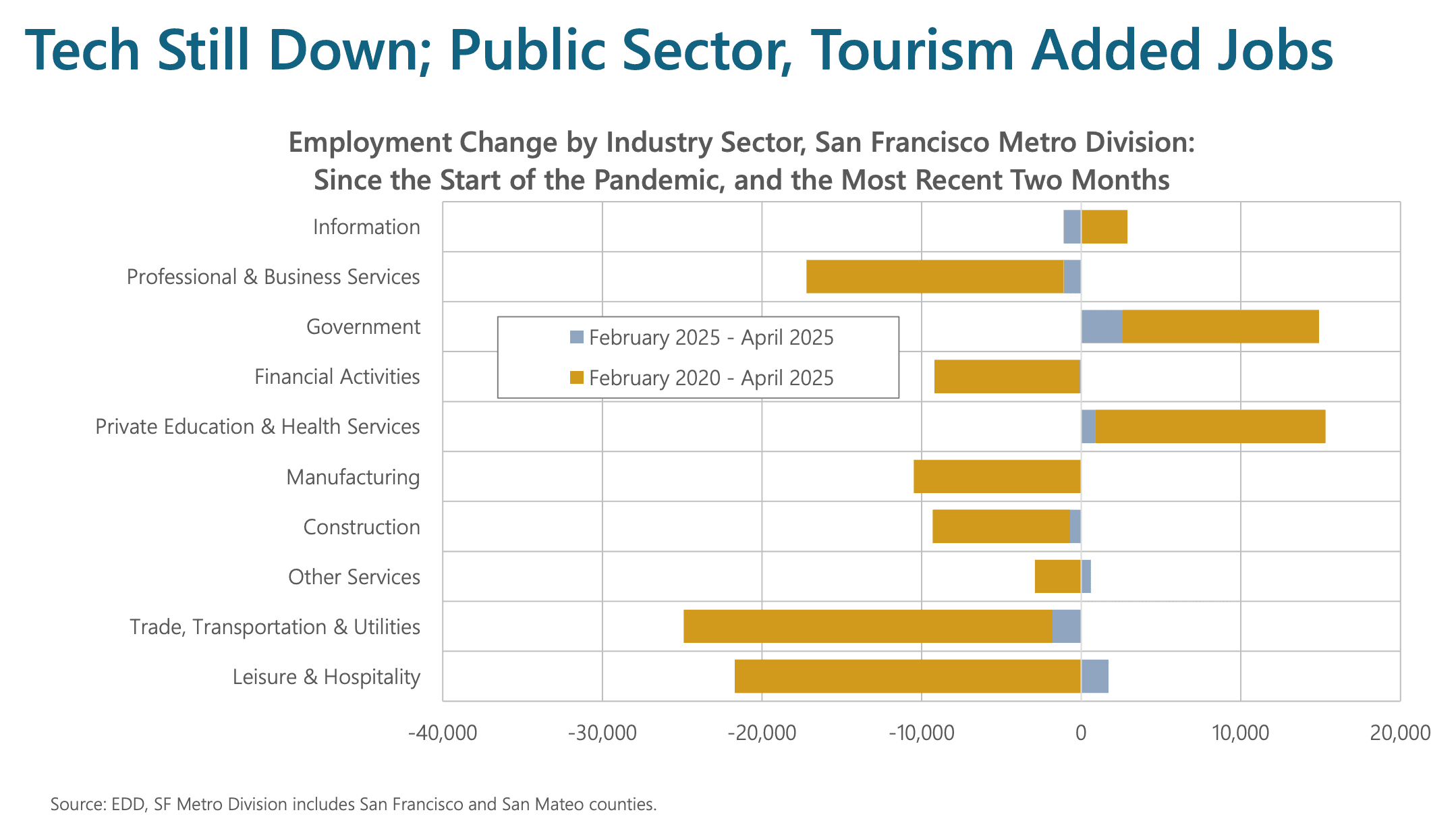

The unemployment rate fell to 3.7% in April 2025, marking continued labor-market resilience, according to the May 2025 report on the Status of the San Francisco Economy. The public sector led local job gains while tech employment contracted over the same period due to some high-profile layoffs. Muni and BART ridership reached post-pandemic highs of about 65% and 38% of 2019 levels, which is encouraging though still far below where we should be. Downtown foot traffic, however, climbed above 75% of 2019 levels. Meanwhile, apartment asking rents surpassed $3,000 per month even as home sale prices remained flat and new housing construction stayed muted, with about 50 housing units permitted in April 2025.

The Context

While downtown foot traffic and transit ridership are both showing encouraging trends toward recovery, ongoing tech-sector layoffs and indications of a national slowdown and possible recession due to macroeconomic policies leave us all in a wait-and-see kind of mood.

These mixed signals arrive as San Francisco adapts to longer-term remote-work trends and faces a slowdown in its core technology economy. Office attendance is still just 40% of its pre-pandemic level, which has knock-on effects on local businesses and the city’s tax base. For a region that depends on sectors from tourism to biotech, this uneven recovery highlights the need for strategies that support both urban vibrancy and economic stability.

Compared to peer cities, New York City’s unemployment rate was 5% in April 2025, and its subway ridership recovered to 75.9% of April 2019 levels with bus ridership at 67.5%. Los Angeles’s unemployment is at 5.8%, and its transit systems is at about 83% of pre-pandemic levels.

The GrowSF Take

GrowSF urges policymakers in City Hall to build on these modest gains by streamlining approvals for infill housing near transit hubs, offering short-term tax relief to small businesses reoccupying vacant ground-floor spaces, and incentivizing shared-workspace conversions in underutilized office buildings. Sustained investment in transit and downtown infrastructure can reinforce ridership gains and economic activity.

Generate a Personalized Email to the Board of Supervisors

To:

Sign up for the GrowSF Report

Our weekly roundup of news & Insights