Prop M tax deal is unraveling

December 17, 2025

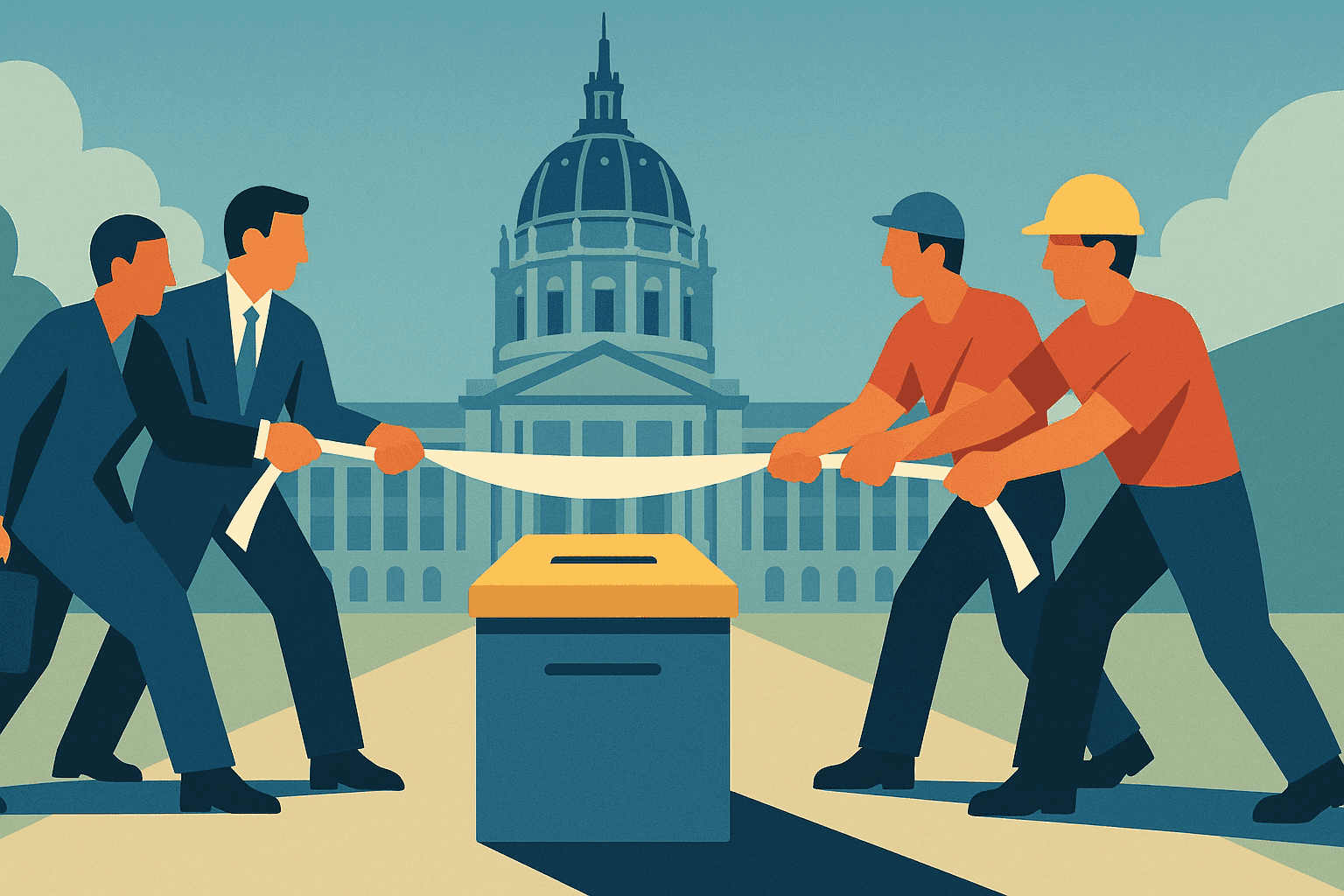

Labor unions and small business are gearing up for dueling tax measures that would rewrite last year’s Prop M compromise. Voters shouldn’t have to referee a special-interest feud over the city’s revenue base.

The Facts

Labor unions, working with Supervisor Connie Chan, are pushing a ballot measure to increase the gross receipts tax, in some cases by 800%, reneging on the deal voters approved last year with Proposition M.

The tax will be scaled up or down based on the ratio of CEO pay to the global median worker pay. Safeway would have almost all of its margins eaten by the new tax, which will be passed on to consumers in the form of higher prices, and may even force Safeway to leave the city entirely.

In response, business groups are now preparing a competing measure for June 2026 that would prevent a tax increase.

The Context

Voters approved Prop. M last year, which restructured business taxes and projected roughly $50M/year in additional revenue after FY 2029–30.

Despite the nickname, the city’s Overpaid Executive Tax is not actually a tax on executives. It's a gross receipts tax, which is a form of sales tax or income tax (depending on how you squint), that is based on the ratio between top executive pay and the global median wage of their workers. The tax is not paid by executives or CEOs, but by consumers of the goods these companies produce.

It is, definitionally, a regressive tax that disproportionately impacts lower-income residents, who spend a larger share of their income on goods and services.

The GrowSF Take

In the words of Adam Lashinsky at The Standard, "All in all, it’s a horrible way to conduct tax policy. The best outcome would be for labor and business to stand down and remove their dueling ballot measures. If that doesn’t happen, the second-best result would be for business to prevail in stopping a foolishly populist effort by organized labor."

San Francisco needs a predictable, pro-growth tax system and disciplined spending, all negotiated in the open and stable enough that we aren’t rewriting the rules every election cycle. Our economy can't recover with constant special-interest tax fights.

Generate a Personalized Email to the Board of Supervisors

To:

Sign up for the GrowSF Report

Our weekly roundup of news & Insights